Table Of Content

His work and expertise has been featured in MarketWatch, Real Simple, Fox Business, VentureBeat, This Old House, Investopedia, Fatherly, Lifehacker, Better Homes & Garden, Property Casualty 360, and elsewhere. The average home insurance premium in the U.S. is $1,754 per year, according to a 2023 Policygenius analysis of home insurance premiums in every U.S. state and ZIP code. Because insurance companies often calculate ACV based on an item's lifespan rather than its physical condition, ACV payouts tend to be far less compared to RCV. Under such agreements, two parties exchange cash flows with each other.

How we make money

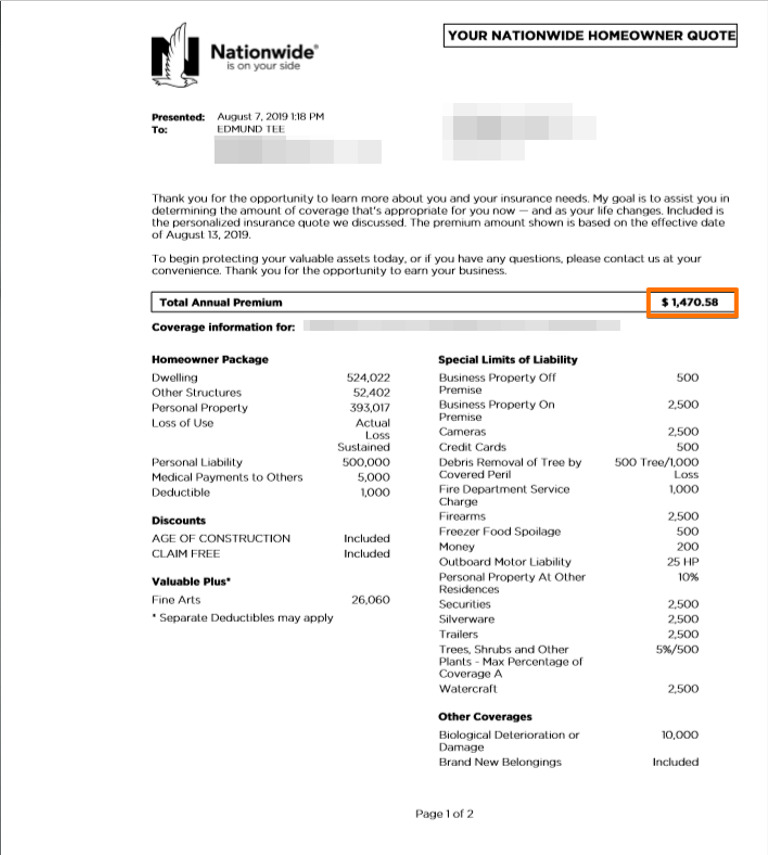

The price for similar coverage can vary drastically among insurers, as you’ll see below. Once you have your quotes on hand, it’s time to go over them with a fine-toothed comb for accuracy. Review the documentation you receive and ensure that each home insurance quote is in line with the information you provided. Your coverage amounts may vary based on each insurance company’s valuation tool, but as long as your quotes are in the same ballpark, you should be able to compare them. Our homeowners insurance calculator will send an API rate call to each insurance company that integrates with Insurance Geek. Currently, we have multiple carriers to compare in each state and more integrations are being built.

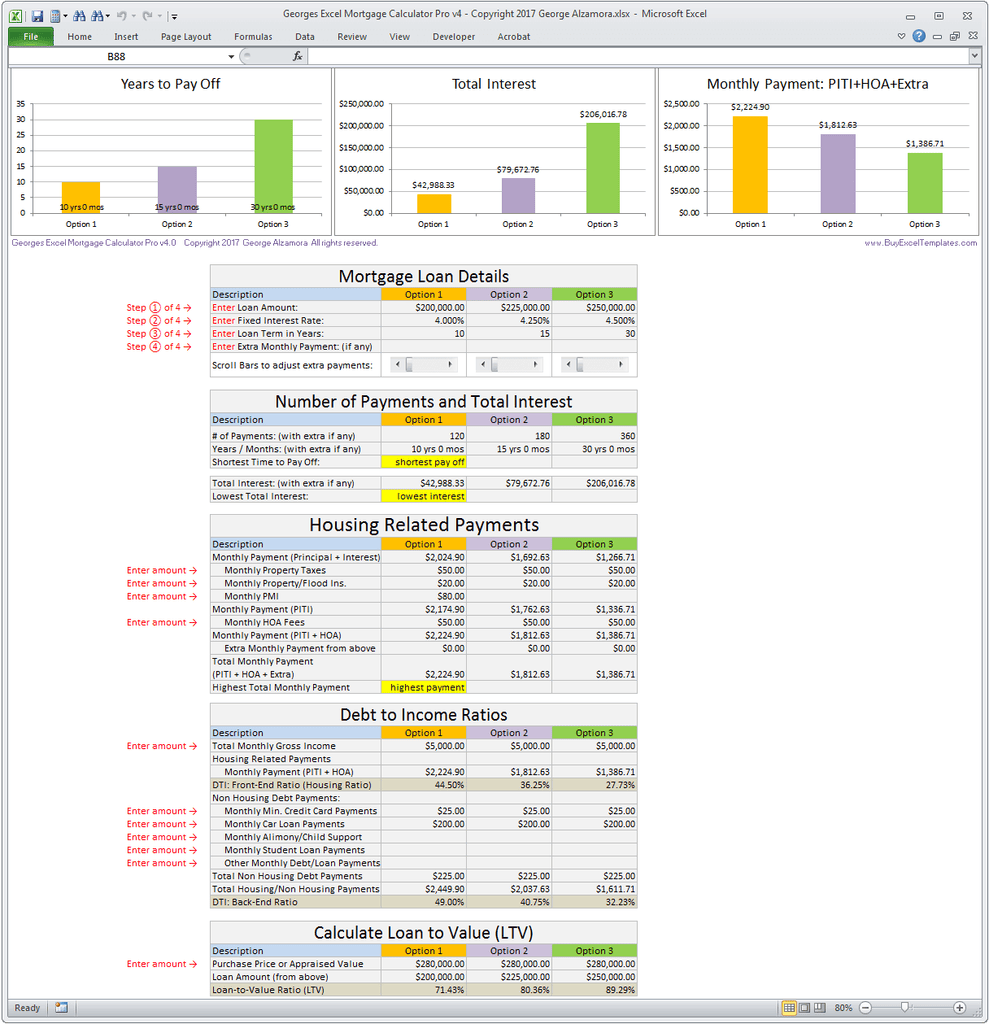

How to calculate mortgage payments

Our experienced agents can help you with any paperwork and to manage your policy. No, a standard home insurance (HO-3) policy does not cover condominiums or rental units. Comparing quotes from top home insurance providers like Allstate, Chubb and State Farm may help you find the right carrier for your needs. Some carriers would require yearly escrows, which they will pay the home insurance premium in full once a year. Going with this route and paying in full can even have benefits in the form of discounts.

Home Insurance Calculator: Estimate Your Costs

Bundling insurance means you buy both your home and auto insurance policies from the same company. A bundling discount is typically one of the better discounts you can obtain. Homeowners insurance companies generally use credit-based insurance scores when calculating rates— except in California, Maryland and Massachusetts. Pat Howard is a managing editor and licensed home insurance expert at Policygenius, where he specializes in homeowners insurance.

Even if you don’t file a claim, insurance companies often raise rates to reflect inflation. If you recently purchased a home or are in the market to buy a house, you may also use the appraisal to help estimate the dwelling value. While this information can help give you a baseline of how much dwelling coverage to quote, property insurers use their own valuation tool to calculate the actual total of your home’s dwelling amount and annual premium. The cost to rebuild your house dictates how much dwelling coverage you should buy.

What is the estimated dollar amount of any jewelry, watches, and furs in your home?

Taking advantage of bundling discounts is an easy way to lower your premiums. Many companies will reduce the homeowners insurance premium if you also have other coverages with them like auto insurance and umbrella insurance. Adding a security system, deadbolt locks, and smoke and carbon monoxide detectors can also help.

Personal property

But to get accurate home insurance quotes, you need to know how much coverage you need. Like most types of insurance, the more claims you have, the more you’ll pay. If you have a more expensive home with high-end finishes, you’ll need a higher dwelling limit and will pay a little more. Policy premiums will be higher if you live in an area prone to unpredictable weather or natural disasters.

We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information.

Best Homeowners Insurance in Oklahoma 2024 - MarketWatch

Best Homeowners Insurance in Oklahoma 2024.

Posted: Mon, 22 Apr 2024 07:00:00 GMT [source]

Power Home Insurance Study — the highest score of all the companies included. USAA also has a lower-than-average premium for home policies with $300K in dwelling coverage, according to proprietary rate data, and your belongings are automatically insured at replacement cost value. However, USAA has strict eligibility requirements and is only available to military members, veterans and their eligible family members. Personal liability coverage (Coverage E) limits typically range from $100,000 to $500,000 on standard homeowners insurance policies. If you need more than $500,000 in personal liability coverage, consider an umbrella insurance policy. And for a more personalized recommendation, you can refer to our list of the best home insurance companies for a variety of coverage needs and preferences.

Whether you already own your house or you're planning on purchasing a new one, it’s important to understand how homeowners insurance is calculated. Getting a rate estimate can be particularly helpful for determining if a certain home or location works (or doesn't work) for your budget. To make sure you have the right cover, re-calculate your rebuild cost whenever you make changes to your home (redecorate or renovate). Each time your policy renews it’s also worth checking the cost is still up-to-date. Remember, your monthly house payment includes more than just repaying the amount you borrowed to purchase the home. The "principal" is the amount you borrowed and have to pay back (the loan itself), and the interest is the amount the lender charges for lending you the money.

As a former claims handler and fraud investigator, Jason Metz has worked on a multitude of complex and multifaceted claims. The insurance industry can be seemingly opaque, and Jason enjoys breaking down confusing terms and products to help others make well-informed decisions. These are sample rates and should be used for comparative purposes only.

Additional coverages may be available to purchase for libel, slander, and other lawsuits. If you need more than a $500,000 liability limit, a separate umbrella policy may provide additional coverage. A licensed insurance agent is best qualified to make that determination, and that’s one of the first steps he or she will take when talking to you about coverage.

Cheapest Homeowners Insurance Providers of April 2024 - MarketWatch

Cheapest Homeowners Insurance Providers of April 2024.

Posted: Wed, 24 Apr 2024 07:00:00 GMT [source]

If you rent your home, you may want a renters insurance policy, which covers your belongings and also includes essential coverage types such as liability, medical payments to others and additional living expenses. A landlord’s insurance will cover damage to the building (but it won’t cover your personal items). To help you understand how to compare homeowners insurance quotes, which often have differing coverage limits and premiums, we’ve included two examples below. Please note that these are example quotes and not representative of actual quoted premiums.

If you don’t, you could be missing out on savings for similar coverage with another insurance company. Progressive has the cheapest homeowners insurance at an average of $746 per year for $350,000 in dwelling coverage, among the companies we analyzed. Progressive also has the cheapest cost of homeowners insurance for $200,000, $500,000 and $750,000 in dwelling coverage. Among the home insurance companies we analyzed, average rates show a cost increase of 32% from $350,000 to $500,000 in dwelling coverage and a 41% cost increase going from $500,000 to $750,000 in coverage. The best way to find an affordable policy without sacrificing coverage is by comparing home insurance quotes from multiple insurers.

That may bea region with severe weather, such as hurricanes or tornadoes. You can get anestimate of your home insurance rates by looking at the average homeinsurance rates for common coverage levels below (rates are with a$1,000 deductible). To get accurate home insurance quotes, you need to know how much coverage you need.

No comments:

Post a Comment